Note: This post is about money. If you’re shy about discussions on earning, growing and spending money, you’re at the wrong place. If you understand the value of money, if you like money, and if you want more of it while keeping your freedom, continue reading this post.

Mid-2019 marked the completion of 2 kickasscular years of living my digital nomad lifestyle. I’m writing this post in September 2019 and as of today, I’ve traveled to 25 countries and ended up with 25 lakhs (INR) in savings at the end of 2 years. I am writing this article from a small island in Indonesia, still enjoying my time on the beach, with a location-independent, financially-stable, and boss-free lifestyle.

In this post, I will be sharing the exact steps I followed to make, save, invest, grow and manage my money without any BS.

P.S. This article is about personal finance and not about the nomad lifestyle. I’m writing this for anyone who wants to meet their financial goals can. By reading my story, you can see how I saved and invested my money and If I can do it – you can do it too.

Table of Contents

Quick points about Location Independence and Money to note before we get started

- Location independence is not for everyone. You shouldn’t want my life because it works well on Instagram. You should want it if you really really want it.

- Working remotely is not possible for everyone. Some skills cannot be manifested offline. For instance, My mother appreciates my lifestyle though she’s a doctor and needs to operate in a given location. Moreover, she doesn’t even want my lifestyle (Refer to #1).

- Income automation is real but like anything else which is desirable, it takes input to get an output. The input can be in terms of effort or money or time or resources. In most cases, and for me, it was all of these.

- If you really want this lifestyle, just know that anyone can do this. I’ve no special background in terms of education or upbringing. Even though I always got the best support possible, My family has a different mindset and often doesn’t understand why I would choose to live the way I live. I’ve no special support or mentorship from anyone else who has done this. My country doesn’t produce many digital nomads and our passport strength sucks big time. All in all, if I can do it – you can do it too.

- Building a stable online business (product or service) is the best way to scale this lifestyle. There are many other “hacks” or “shortcuts” which I’m not talking about here. A remote job is an another way which would work really well if you prefer a fixed income while being a nomad.

- Saving is useful only when it’s invested. There is no point in keeping money in the bank. Most of the process is about investing and not about saving. Money in the bank makes more money for your bank, not for you.

- Spending is key to this lifestyle, unlike common financial advice. Most financial advice is focused on saving but without spending it, you cannot live the life you were saving for! I know what I like to spend on and this lifestyle lets me 10x that expenditure. I’m from a middle-class family but I haven’t inherited the middle-class mentality.

Here’s how I’ve been living my life in the past 2 years

- I’ve been traveling constantly, mostly the local, slow way and a few times the more fast, touristy way. I appreciate both ways of travel – slow and fast, but slow more 🙂

- I’ve visited and explored 25 countries in these 2 years – Portugal, Spain, Thailand, France, Germany, Belgium, Indonesia, Malaysia, Singapore, Netherlands, Italy, Vietnam, Austria, Poland, Laos, and Cambodia have been some of my favorites.

- As you can see, I alternative between more expensive and budget travel. I also alternate between local homestays and luxury resorts. This helps manage the cost of travel while getting both local (more heart, connections, and cultural) and luxury (more relaxed, comfy beds, services, and facilities) experiences.

- Here are some of the best experiences I’ve had during my travels so far.

- I’ve been running many parallel revenue sources while traveling – all of them online – with a lot of focus on my online academy where I train marketers and entrepreneurs on growth hacking.

Like I mentioned earlier, this post is not going to be about my experiences, travels, or lifestyle. It’s going to be about my finances. I will share how I saved and grew my money with actionable steps you can follow as well.

Disclaimer:

- I started at ZERO and took no money from family after the age of 21. (I’m 29 now)

- When I was 21, my mother gifted me a new laptop and a train ticket to Bangalore – that was the last funding from family 🙂

- I have no investors or mentors and I won’t talk about the importance of mentors here.

- I didn’t start my journey with a nomadic lifestyle.

- I started by building and managing a full-time, all-the-time office-based business in Bangalore, India and slowly transitioned to the nomad lifestyle.

Lesson #1: It’s All About The Cash Flow

Remember what you’re looking for is not money, but cash flow. Here’s how I think about cash flow:

- Incoming (Revenue)

- Holding (Accounts should be near-zero)

- Outgoing (Expense)

- Investment (All savings go here)

The incoming is all the revenue streams you have. I don’t have a job or full-time engagement which helps me maintain my freedom so I don’t really have a “fixed income” revenue stream. This helps a lot as then I am free to generate multiple revenue streams.

The holding is the bank accounts, savings, cash on hand, and any other channels where you “hold” the money. My goal is always to keep the holding = 0.

The idea is to split the holdings (#2) into #3 (outgoing) and #4 (investment). The outgoing is everything I spend to drive my incoming (#1) which includes technology, tools, marketing, and salaries (I have freelancers and remote teams who work for me – yes I didn’t say “with me” – sorry HR executives – because I am an old-school boss operating in a modern startup ecosystem getting process-oriented results without all the bloated beer and dry pizza).

Everything that’s left goes into Investment (#4). This is where a big difference is. Most people are holding this amount in #2 while I make sure my holding is always 0 by moving all of it to #4.

Lesson #2: Creating Multiple Revenue Streams

When you work a stupid job you don’t like, you can’t have #2. Don’t listen to the IIT and IIM grads who message you on LinkedIn for those network marketing scams. They should be the first ones to know what really works is building stable revenue streams. You need these streams only until you have enough to start investing and making your money work for you.

My revenue streams (not in the order of value generated):

- My online academy for startup growth (online courses and books)

- Online services – marketing, websites, design

- Growth Hacking consultation service

- Affiliate marketing commissions

- Google Adwords on multiple blogging websites

These are the top 5 sources of revenue for me. #1, #4, and #5 are mostly automated in terms of operation. However, I spend a lot of energy and focus on #1 for new content creation and marketing. For #2, I work with a team of freelancers and highly-skilled remote employees. For #3, I exchange my hours for a high fee. This is the least scalable but the most fun. I love it.

Talking about passion, I do not necessarily love everything I do. But here’s what I do love: CASH FLOW. I love cash flow and hence, I have no regrets in working for my cash flow.

Lesson #3: Being Debt-Free & Managing Income Instability

I never cared about a monthly stable income. I only care about how much money I can put into an investment every year and make it grow. This is one of the reasons I have no issue when I make 50% less this month than last month.

I also have no loans or EMIs. I never got into that shit.

I also never took money from my family as I started blogging while I was still at school and eventually moved into multiple other online avenues – all roads eventually leading to becoming a startup growth hacker which is my main role now.

It’s important to have no debts in order to live a lifestyle which is initially financially unstable. If you’re engaged in a full-time business operation, then debt might be required and useful – and even desirable for growth. But in independent nomadic life, it can ruin the entire experience.

So the key is to start with no debts. If you’re new to personal finance or the digital nomad lifestyle, remember that for both you should start from a place of 0 financial debts.

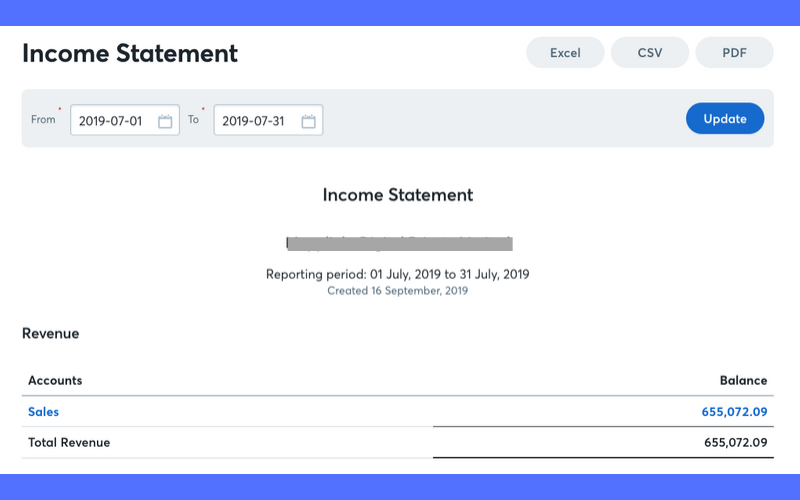

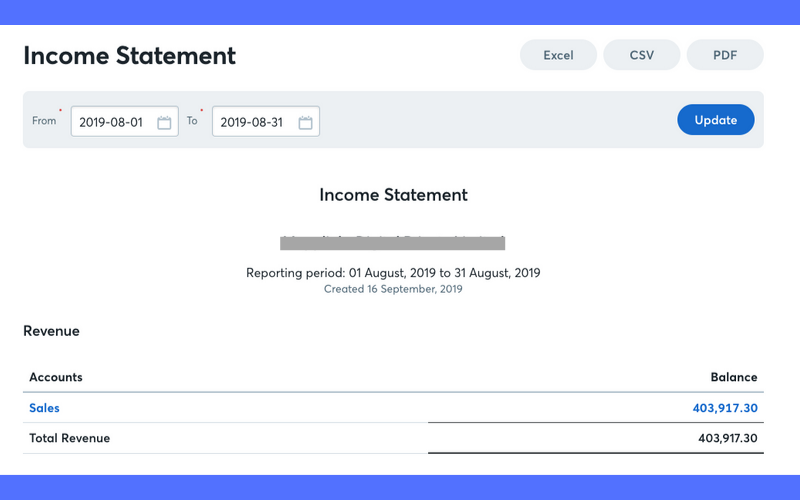

Here’s an example of the instability of revenue from the past 2 months (July vs August 2019) from one of the revenue streams:

The point here is the revenue is not regular or fixed. It might be even lower or 4x higher in September.

I don’t have too many monthly commitments (no loans/debts) and my investment and expense on a recurring basis are manageable. Most importantly, I have other revenue streams which can fill in for any critical requirements. This is how multiple revenue streams help manage instability of finances.

Lesson #4: Financial Foundations for a Digital Nomad Life

There is a set of financial foundations you should have in place before you can manifest a comfortable digital nomad lifestyle. These are also applicable for a regular way of life or any other special lifestyle (FIRE, etc).

Before you start with the following checklist, you should also consider selling everything you own as doing that puts you ahead of the things you own.

- Start Debt Free (Lesson #3)

- Get a life insurance

- Get medical insurance with international coverage

- Max out on the basic tax investments

You should have the above in place before you start using the money for traveling. These are essentials and cannot be ignored.

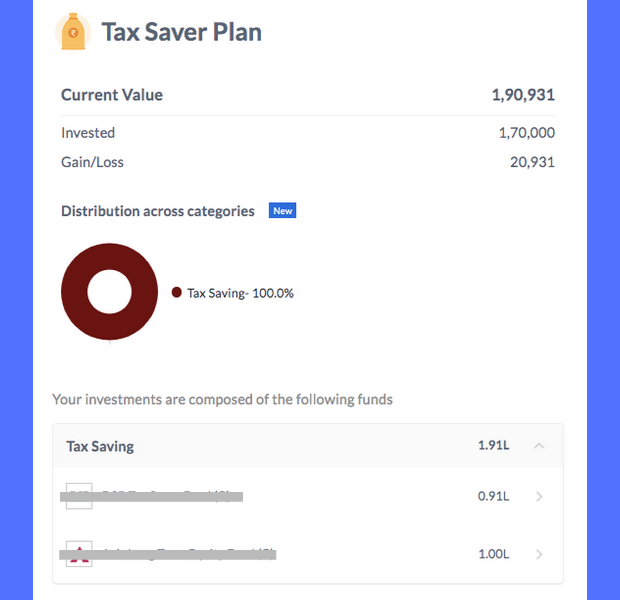

For #4, you can use LIC or tax-saving mutual funds (recommended) and invest there to get the maximum tax benefit. The worst thing you can do for your personal finances is to pay high taxes.

I prefer ELSS funds over the other instruments available under Section 80C, Income Tax Act. I’ve also been seeing an okay growth in my ELSS investments apart from the tax-saving advantage even when the market is down.

Lesson #5: Leveraging Credit Cards – Float Money and Rewards

A credit card, when used properly, is a great tool for saving and growing money. It acts as an “interest-free loan” for around 45 days which is what we call “float money”.

Float money is what you can use for your expenses without having to keep a lot of “holding” money. As I mentioned in Lesson #1, the goal is to have near-zero or minimal holding amount. That is, you need to push your money from your bank accounts to investments and use the money from credit cards for expenses as much as possible.

Apart from the float advantage of credit cards, they also get me amazing rewards which fuel the digital nomad life – including free flights and hotel stays.

Here are the 2 credit cards I use currently:

- HDFC Regalia

- American Express Platinum

Both of them are premium cards with high limits so I can get the maximum advantage of float and reward points. Both have reward programs with great benefits, especially to the nomad life. If you’re going to be traveling, you should skip the “shopping” credit cards and focus on ones with more benefits on travel. (Unless you’re traveling for shopping!)

The important thing is to pay your credit card bills on time. Credit card companies will start winning and you will lose all the advantage once you start delaying your payments.

2 important takeaways:

- Pay your bills on time

- Max out on the float amount and use it 100%

For example, it is mid-September 2019 now and I’ve used close to 50% of my float already. This is perfect considering I still have half a month to go. I’ve also never delayed a credit card payment.

The standing on the Amex card is similar though the limit is higher and I’m usually not able to use the entire float amount in which case, I use the float money for investments when I can forecast an incoming in the coming weeks.

When it comes to rewards, I’ve had the last 2 flights and my last hotel stay for free and I still have enough points to book new flights using my previous Jetprivilege points, which are now really ‘more powerful than ever’ as you can use them for almost any airline.

Lesson #6: Investing is the Key to Growth

While all the above lessons are important, #1 and #6 are probably the most important of them all.

You already understand that your holding amount should be 0. This means you need to move all the money so it can work for you and make more money for you. Your money needs to go out in the world – work for you, make babies for you, multiply for you. You’re not going to get wealthy by sliding it under your bed.

I talk about the law of unavoidable variation in my upcoming book on ‘The Art of Growth Hacking’ where I explain how variation, either increase or decrease, of any metric over time is unavoidable.

So If you keep INR 1000 cash under your bed and forget about it, don’t expect to get INR 1000 back the next year you look under your bed.

Your INR 1000 would now be either more or less than INR 1000 based on the inflation and the value of the money itself.

You would’ve also lost the money this INR 1000 could’ve made for you by being invested in the right assets.

This is true even on a more micro-timeline. Every day, you’re either losing or gaining money. If your money is in your savings account, you’re pretty much always losing it. If you pay a bill from your credit card (as explained in Lesson #5) over using a debit card or cash, you’re probably gaining a little as you’re using the “float” money from your credit card which can be paid for after 45 days.

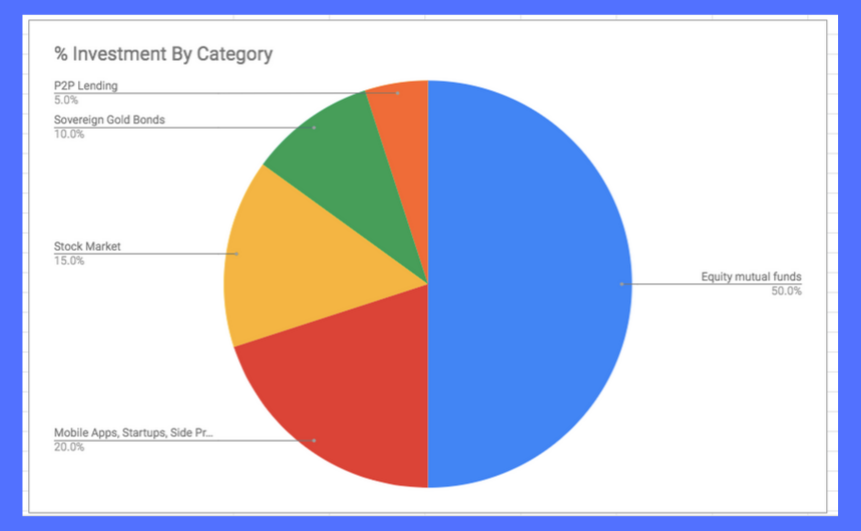

Now, I’ll share the asset classes where I’ve invested this money is saved over 2 years with the % split of the current total amount.

- Equity Mutual Funds (50%)

- Mobile Apps, Startups, Side Projects (20%)

- Stock Market (15%)

- Sovereign Gold Bonds (10%)

- P2P Lending (5%)

- Sweep-In Deposit (For temporary holding)

Regular deposits (FDs, etc) are for the middle-class mindset and they’re definitely not going to make your money work for you (the idea of the middle-class is to work for money instead) but you can still activate a sweep-in deposit on your bank account for the temporary duration you keep the holding amount for.

Just a note here: I’m middle class and from a middle-class family but I don’t wish to maintain or carry forward their mindset. The mindset shift if more important than your current situation.

I’ll talk briefly about all my investments here and a more detailed version will be available in this course.

Lesson #7: Building a Solid Investment Portfolio

Before I get into the details of my entire investment portfolio, let me answer the most common question first:

Why I have 50% of all my money in Equity Mutual Funds?

People are often talking about the market being down and the fall of mutual funds in the current Indian market situation. However, this is not a valid argument as “the current value” of mutual funds doesn’t matter. A mutual fund is for long-term wealth creation and not for a short trade.

I started investing in mutual funds around 3.5 years ago and I only review my funds once or twice every 2 years. While everyone is worried about their fund value going down, I’m just adding more units as swiftly as possible as this is what will grow in the future and the market will come back up as we’re a growing country of young people.

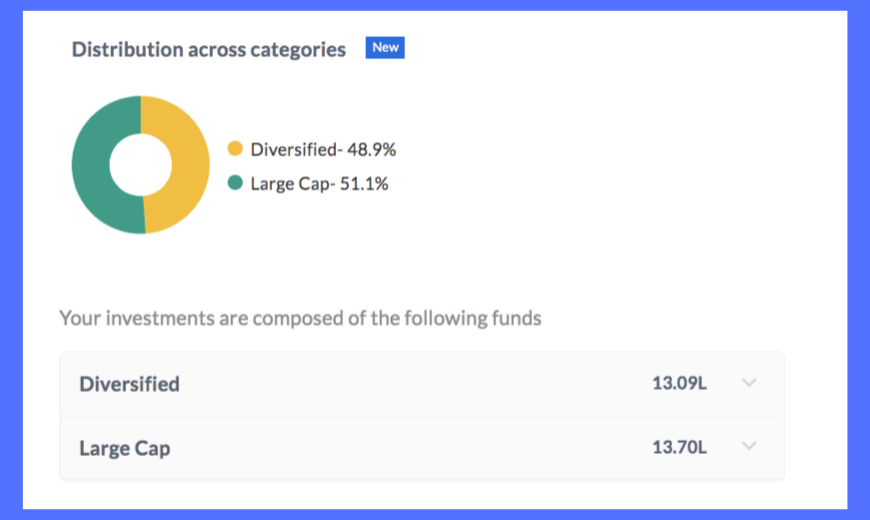

I have close to a 50:50 split between diversified and large-cap mutual funds and I’ve almost never seen a negative return on my funds. That’s probably because I don’t check in with the funds’ status often. The amount is close to INR 27 lakhs currently and I have a target to grow the equity funds to 1 Crore with regular investments every month.

I don’t keep a SIP since I don’t have a fixed monthly income but I add instructions to the investment in advance based on my forecasting of the incoming and holding amounts (refer to Lesson #1).

I will share the names of all the mutual funds I’ve invested in if you want (just ask in the comments on this article) but I have no clue if the same will work for you or not. It’ll depend on how you manage it and how regular and systematic you are.

Here are 2 of the largest investments in the large-cap category which I would definitely recommend though:

Overall, I would like to say “Mutual fund sahi hai” 🙂

Other Investments:

Mobile Apps, Startups, Side Projects (20%) – I often get ideas for new apps or side projects. I ideate them and find freelancers to work on the same. Once it’s ready, I either launch it for growth hacking or for revenue.

Stock Market (15%) – I hold stocks long term. I don’t do day trading. I want to sip a drink on the beach and not worry about the price of a share going up or down. I invest in companies which either I use myself or see many people use every day after doing a fair amount of research on them. I don’t subscribe to or listen to any market calls.

3 companies that I’m holding shares (long-term) are listed below:

- BRITANNIA: snacking is cool in our society for some reason and Indians love milk

- ITC: smoking is addictive like processed foods, people have a hard time overcoming their addictions, and Incense Sticks are a religious necessity in a religious country

- CIPLA: people get sick all the time

Professionally run banks are also good options but I prefer the above. I’ve never been disappointed with the returns from these 3 companies.

Disclaimer: I don’t recommend any stocks to anyone as your timing and situation could be wrong and you might lose money. I am not a broker and I have no interest in telling you where to put your money. I am only sharing what has worked for me.

Sovereign Gold Bonds (10%) – This is the only investment issued by the government of India that I have. I get 2.5% annual return and I can sell the gold bonds at the market value after the holding period. It’s a great investment especially if you’re not someone who wants to keep physical gold with you (which is usually the women).

P2P Lending (5%) – High-risk, high-return. I’ve got an average 25% return through P2P lending over the past year with no default so far. I keep 5% here and diversify by allocating small amounts to people with good standing and rating.

Note that for a digital nomad, real estate investment is not recommended however an Airbnb live-in and flip strategy is a good idea (as a revenue stream and not an investment) and can work wonders if done right. I’ve done this in Vietnam and my listings can be found here. However, I chose to give away all the earnings from this strategy to the local families in Vietnam I love.

Tools I’ve Used:

Here are the tools I’ve used in this journey and you can also give them a try to help your financial journey. The tools you use will be up to you but I’m mentioning these here because all these tools have worked wonders for me and they deserve a shoutout.

- Scripbox (mutual fund investments)

- Kite by Zerodha (stock market investments)

- Walnut App (tracking personal expenses)

- LendBox (P2P lending)

- Yes Bank (savings account) and Kotak Bank (auto-sweep account)

I will also add a more detailed list of tools in the course. There are probably around 10 personal finance apps on my phone right now. Technology can help us make money if we use it properly. I also want to give a big shoutout to Finology by Pranjal Kamra who I’ve learned a lot from about investing in India.

My current process:

- Step 1: Work on multiple revenue streams

- Step 2: Review holding amount regularly

- Step 3: Pay bills and people

- Step 4: Move the rest to investments

I repeat the above and it helps me keep growing my income. This is the same process I’ve been following over the past 2 years. The idea is to always try to keep the holding amount near-zero. It is really that simple.

I know many of you may have questions about this post – feel free to leave a comment on the article and I promise I will answer them.

Next Steps

Going forward, I will publish 3 tutorials like these (both articles and ebooks, possibly also videos) at the following milestones:

- INR 25 lakhs (achieved)

- INR 50 lakhs

- INR 75 lakhs

- 1 Crore

- Every crore until $1M

Note that the target is in terms of liquid investments so it is like cash I can take out and use at any time.

This will help you follow my journey to INR 1 Crore and ultimately to $1M. This should be more helpful than watching those you’ve already made it or reading articles from those who haven’t even made it and just write from research.

I invite you to be part of this journey with me.

When you sign up for the course, I will also share regular updates on my personal finance journey and all the milestone updates from my financial goals.

Till then, let’s talk in the comments.

All the best,

Rishabh Dev.

This is too good Rishabh. Wish this advice would have come to me 15 years ago.

Same here. I’m just wondering now how cool it would be if I started SIP investments 15 years ago. Even an average of Rs 500 per month for the first few years (chocolate-money) and increasing it gradually would compound to a lot of bank by now – instead of all the fat accumulated from that chocolate and those sweets! I’m now working out every day to cut that too. We grew up with so much BS. No one wanted us to learn how to manage and grow money and hence, wanted to share this with all.

Hey Rishabh!

I stumbled upon your blog from a WhatsApp forward. I must say I really liked your journey and would love to scale like you did (don’t’ want a nomad lifestyle).

I liked how you have diversified your income streams (Yes. I come from a middle-class Indian family too) and I am literally on the same path (just 22 now)

Thank You so much for writing. I have enrolled in many of your free courses now.

Would love to connect with you!

Regards,

Punit Mahajan

Hi Punit,

I appreciate the comment and I really understand you – I was looking for a blog like this around 3-4 years ago when I first started thinking about personal finance seriously. But guess what, I couldn’t find step-by-step instructions with actionable advice, all in one place, for our country, anywhere. I wanted to write this for anyone else who wants to walk this path – and I’m sure many do.

These are not really steps for digital nomads – it’s for anyone who wants to meet their personal finance milestones as you already understand. I want to wish you all the best for your journey and feel free anytime to continue this conversation and I’ll help out any way I can.

All the best,

Rishabh Dev

Hi Rishabh,

Have been working for about 15 years now but started Saving (Investing) only 2 years back, thanks to Scripbox. I always knew that I started too late on investing. Have been saving because I want to be a travel blogger. I know it is not much, but I will have about 5L in my Scripbox account by the end of Mar’20. My first big saving. Am looking out for ways to have a revenue without a fixed job. Must say, your blog has given a lot of insight and info. May be some day I too can reach my goals.

Hi Shilpa,

Good to hear from you and thanks for reading. I’m excited for you and happy to learn about your first milestone. Travel blogging is a great place to be in order to generate revenue (and even a sponsored lifestyle) without fixed income. I’ve worked as a travel influencer myself and it’s been a lot of fun. If you can get the right partnerships with travel brands, it can become a good revenue stream. However, it’s always a good idea to experiment with multiple revenue streams and funnel down on what gives you the most ROI and satisfaction. All the best for your goals. If you ever need any help, just reply here and I’ll be happy to add my inputs.

Hi,

I took a loan and started a salon spending 3 lakhs. I am salaried and 80% of my salary gone in EMI rest 20 % gone in rent of salon. After that for daily uses I used CC.

Question is how I cleared this debt as I am fed up with these EMIs.

That’s right Pravesh, you cannot hit your net worth milestone without getting debt free unless you’re using debt the right way. Debt can be good or bad based on how we use it. Assuming you’ve taken a loan for your business, the best way to clear the debt is to drive revenue from your business.

I started my services company in 2012 and we were profitable from Day 1 and that’s how we managed the cash flow.

If I was you, I would run some growth hacks to drive revenue from my salon which would first clear my debt and then start hitting my personal finance milestones by moving the profits to investments.

Hey rishabh,

Firstly this was a joy to read and a very well written article and love the process with the discipline that you’ve maintained! Very good timing of this post as I just hired a SEBI registered financial planner this month for my portfolio and investment planning due to high holding amounts.

Loved and learnt these points:

– holding = 0 – crucial eye opener for me and important.

– multiple steams of income and regular cash flow

To add from my experience:

– LIC is probably not a very good life insurance plan, in fact none are. We only need a basic term plan and nothing else…important point for all

– Mutual funds – use ONLY DIRECT funds. Or you’ll be paying a 30-40 lakh commission on a 1.5 Crore corpus in 10 years just because of 1% extra expense ratio, highly researched fact done by Tony Robbins and many folks at zerodha coin also.

– Emergency fund – this is crucial to be there in any form that can be retrieved in 24-48 hours

– war chest fund – I do this to start new businesses and also new forms of investment like crypto etc whenever I want.

– goal based investing – attach each form of investment to small, medium and long term goals – doing this now with financial planner

Quick q’s :

Can you share more about approaches on P2P lending and side projects investments?

Hey Pravin,

That sounds great – Let me know what your financial planner thinks about this article and his inputs as well!

You’ve brought up some very interesting points so I’m going to expand a little on the same:

1. The holding amount is not very intuitive at first mostly because we were taught to save backup money in bank accounts, making only the banks richer.

2. Multiple streams of income – adding to that the streams should not all be monthly payments – they should be irregular / weekly / higher-frequency / random payments or a combination of different payment schedules – this helps manage bills and expenses without needing holdings

3. Good point about life insurance

4. That’s right about direct funds however in some cases for absolute beginners (like my 18-year-old cousin brother who needs to use his chocolate money) it’s just more convenient and easier to start with regular funds, learn the game and they go, and switch to direct funds once they’re little savvier.

5. The war chest fund – where is this amount kept? In cash?

6. Goal-based investing for me works best when I know how much money I need at what age. For other people, it might be a good idea to goal a car or goal a house, or a family, kid’s education etc.

To answer the question about P2P lending, I’m actually doing a guest post with Lendbox currently and I’ll share the same soon. The core idea is to find medium-risk asks and then diversify aggressively by lending small amounts to each asker.

The side-project investments I focus on are usually mobile apps with either a small download fee or in-app purchases. I get these developed by freelancers and promote them on the app stores.

Thanks, Rishabh for this wonderful writing.

This is real stuff. this is like an “all at once place” good to go, step by step process which, I believe, should be followed by everyone, no matter if they start small or big.

Thanks again, and as always, wish you all the very best ahead.

Gonna meet you, someday… 🙂

Thanks for appreciating – and yes, anyone can follow these steps. I’ve tried to keep it as actionable as possible exactly based on what I did. Thank you and will be happy to meet you 🙂

Hey Rishabh,

This was one of the best reads after a long long time I must say.

I have a question, though!

If you keep the holding amount in your bank close to zero, from where do you use the money for your daily expenses, some bigger monthly expenses, emergency, etc.

Also, I’d love to know about the list of mutual funds you’re currently investing your money in.

Once again thanks for this amazing value bomb. Appreciate it.

Hi Yash,

Thanks for appreciating. That’s an excellent question – I use the credit card for almost all of my expenses. I prefer using digital equivalents of any brick-and-mortar stores or services so as to make sure I can pay by the credit cards. Since my revenue streams are incoming throughout the month (another advantage of not relying on a fixed monthly income), I usually have payments coming in every week – sometimes multiple payments per week. So I don’t really have to worry about credit card bills as they would show up only after 45 days. I just make sure my incoming would be sufficient to meet the bill at the end of the credit card cycle and this is always the case because I make more than I spend. And it’s not that is spend less, I just make more.

My current mutual fund portfolio is:

1. UTI Equity Fund

2. Kotak Standard Multicap Fund

3. SBI Blue Chip Fund

4. ICICI Prudential Value Discovery Fund

5. Mirae Asset Large Cap Fund

I’m not really investing regularly in #1 and #4. I also have my own SIP alternative as SIP is more suited for a fixed monthly income – Instead, I give pre-instructions every few weeks based on the incoming streams in order to manage market volatility. Sometimes, these are weekly investments of small amounts. Sometimes, I schedule them every 2 weeks.

Let me know if you have any other questions.

Wish you the best, Yash 🙂

Hi Rishab,

Thanks for reply and can I know what would be your strategy I you belong to this business, so that I can get a idea try to do the same ?

Thanks

Pravesh

Hi Pravesh,

I’ve shared all my revenue streams and detailed investment strategy in the post. Do let me know any other specific info you’re looking for in terms of business or personal finance and I’ll be happy to share that with you as well.

Thanks for reaching out 🙂

Hi Rishab,

Thanks for reply and can you please suggest me what would be your strategy if you are in this business. So that I can use that and save from bankrupt.

Thanks

Pravesh

Hi Pravesh, I understand you’re looking for ways to promote your salon. You should start by thinking about the channels where your target audience hangs out and then plan frugal ways to get them to your business. I create growth strategies professionally through my consulting business alternatively would suggest my free growth hacking course where you can learn how to do this yourself. All the best!

Hey Rishab,

I am from the facebook group, I am really fascinated by your ideas and thoughts in the posts. I wanted to be a Digital Nomad for the best time of my life. I am currently 23 years old and earning peanuts (15k) and simultaneously working on my blogs to foreseeable future.

My request is, please suggest best investment plans based on my current income as you mentioned in the above reply that you wasted 15 years of time and chocolate money.

Thank You for writing this beautiful post 🙂

Hi Srihari,

With your current income, I would recommend starting a small SIP (of whatever amount you can save each month) into 2 large-cap mutual funds. Don’t experiment with the stock market with your current amount as it’ll only demotivate you. Instead, keep your #1 goal as increasing the income. And as your income increases, keep adding to the mutual funds. Once you’re able to double the investment amount, add 2 mid-cap funds. These will go a long way when you keep adding investment amounts and you’ll be surprised at the amount it’ll compound to by the time you’re 30 🙂

So the next steps for you:

1. Start a monthly SIP with a small amount what you can save each month into 2 mutual funds

2. Find ways to add revenue by creating new revenue streams or increasing the current one

Hi Rishabh ,

Amazing to read this stuff and all at one place. Really loved how you explained every part of it. I would just personally want to know about your free courses (if any ) so that I could get some learnings through out .

Thanks in advance 🙂

Hi Shivam,

Thanks for reaching out.

All my courses (both free and premium content) are available here at Mapplinks Academy – http://academy.mapplinks.com.

All the best!

Hi Rishabh,

Thanks for this valuable information. I am sure it turns out to be useful to many people out there. Though, I have one question – You mentioned about the holdings to be kept almost zero and use credit cards for the expenses(float money) Now, when i get to make the payment of my credit card after 45 days, how do I manage that if I keep my holdings to almost zero.

Thanks and keep sharing such informative articles 🙂

-Ish

Hi Ish,

Thanks for posting this question as I’m sure many others would like to know the answer to the same.

The answer to this question, in short, would be CASH FLOW. This is where cash flow and multiple revenue streams play an important role. I’ve built a running cash flow through multiple revenue streams where the payments keep coming in on a weekly basis. This lets me monitor and manage my outstanding credit card bills among other expenses with the revenue streams without having to use my holdings (which is anyway a negligible amount in my case).

Once you’ve built different revenue streams paying you on a higher frequency vs a fixed monthly salary, it’ll be easier for you to clear all your credit bills over a regular salaried employee 🙂

Hope that answers your question and wish you all the best for your personal finance journey.

– Rishabh Dev

Hey Rishabh,

Thank for you such an amazing and detailed blog post.

I was wondering what are you using to track your money? These snapshots which you have added are from some software or created just for visualization purpose?

Hi Taranjeet,

I use Scripbox for managing my mutual fund investments. Since most of the amount is in equity funds, the screenshots you see are mostly from Scripbox.

However, to manage the overall financial situation and the different accounts, I maintain a custom Google Sheet that I’ve created as a ‘Personal Finance Tracker’ and it gets updates every month.

Hi Rishabh, we are from middle class.. my family is middle class… We can’t help getting out of this mindset.. even if somehow try to move above this mindset, family works as restraint to it and their influence does not allow evolve from this mindset.. how to overcome these barriers..

That’s a very important question Pravesh as it’s not possible to achieve any of your goals without building the right mindset first which is required for you to execute and work toward the goal. That being said, the most powerful influence on your mindset is your own thoughts and how to perceive things.

I’m also from a typical middle-class family and I worked very hard to change my mindset and shift it to a cashflow-friendly mindset instead. If you’re strong to tell your brain how you want it to work, it’ll be really difficult for any of your family members or society to affect you negatively. They mostly care about us and don’t know of any better way so they would like us to follow what worked for them to have a decent/safe life. However, when we need more and better results than what they had, we need a mindset shift and a new process to help achieve our goals.

I also moved around a lot and getting out of the environment was something that helped me focus on what really matters for my personal development and goals rather than national politics, sports, drinking, or whatever people are into these days. Sometimes going alone in silence for a while helps us re-wire our brains and fortunately for me, I had a lot of this me time to reflect. Travel also builds new connections in the brain which are helpful to aid a mindset shift.

I would suggest all the above methods and if none of these are possible just to be very strong in the head and focus only on changing the way you think (about money in this case) – so strong that no one else can affect it negatively. Also take note that If someone wants to fuel it and improve your process, be open to listening to them.

hi rishabh,

great article. i learned quite a lot from this content and i am also very inspired to reach your level of success someday.

i have a basic question:

which banks do you suggest i should use in india? i mean i have 2 accounts. one in SBI and other in INDIAN BANK but their online services and customer care is pretty horrible.

i mainly earn through my websites (affiliate commissions + ad revenue) and i pay for my expenses every month in dollars through my SBI debit card.

but, i really want a more efficient banking system to handle all my international payment needs as well as give me some benefits when i travel.

so what are your bank recommendations? icici, hdfc or something else?

thanks

Hi Vijay, I feel most Indian banks are more or less the same when it comes to foundational flexibility as the core is still based on RBI guidelines. But what they do differ is in terms of service and, for me, the UI/UX of their interfaces. This is important for me as I’m always using them on the go. In that sense, I’ve found the Kotak mobile banking experience to be the best.