As promised, I’m sharing the latest addition to my midcap portfolio: The Kotak Emerging Equity fund. I’m going to share my midcap investing strategy and why I have 2 mutual funds in this category.

Table of Contents

Why I added a second fund

While you might have heard of the advice of keeping 1 mutual fund per category, and it was something I followed for a few years until:

- My portfolio grew in size

- Some Franklin mutual fund schemes got shut down (even though I wasn’t invested in them)

- Axis mutual fund front running case (and I was invested in it)

- I learned more about mutual fund overlap

Basically, I learned more and lost more trust in mutual fund houses to keep all my money in one category with a single fund.

I now have 2 mid-cap funds and 2 small-cap funds instead of 1 per category (as I had before).

Having a single midcap fund in your portfolio carries the risk of being overly dependent on the performance of a single fund manager and their investment strategy.

Reasons to switch to 2 funds per category

By adding a new midcap fund for diversification, you can potentially enhance the risk-return profile of your portfolio in several ways:

Reduced concentration risk:

Investing in a single midcap fund exposes you to the performance and volatility of a limited number of stocks and sectors. By diversifying across two midcap funds, you can spread your investments across a broader range of stocks and sectors, reducing the impact of poor performance from a single fund.

Access to different investment styles:

Each midcap fund may have a unique investment approach and style. By investing in multiple funds, you can gain exposure to different fund managers who may have different strategies, perspectives, and expertise. This allows you to benefit from the strengths of different investment styles and potentially achieve more balanced risk-adjusted returns.

Enhanced portfolio flexibility:

Owning two midcap funds gives you the flexibility to adjust your portfolio allocation between the two funds based on market conditions, fund performance, and investment objectives.

Risk mitigation:

Diversifying across multiple midcap funds helps to mitigate the risk of poor performance from a single fund. If one fund underperforms, the potential impact on your overall portfolio is reduced because the other fund(s) may still deliver positive returns.

This diversification can help to smooth out the overall volatility of your portfolio.

Just remember: you cannot trust these fund houses and what if one of them defaults?

Potential for improved performance:

Different midcap funds may have varying portfolio holdings and sector allocations. By combining two funds, you can potentially benefit from more comprehensive coverage of midcap stocks and sectors, increasing the likelihood of capturing attractive investment opportunities and achieving better overall performance.

On the flip side, you might say I might get results similar to the midcap index. First, I feel the midcap and small-cap universe is HUGE. Second, even if I get results similar to the midcap index, I’m okay with it!

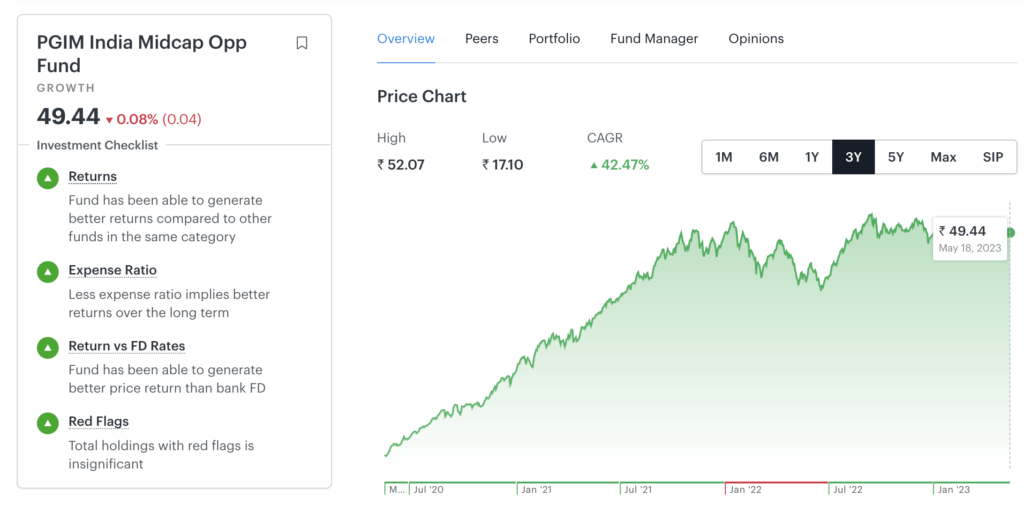

Fund 1: PGIM India Midcap Opportunities Fund

This is my first pick in the midcap category.

| Fund Name | PGIM India Midcap Opportunities Fund |

| Fund Type | Mid-cap equity fund |

| Fund Objective | To achieve long-term capital appreciation by predominantly investing in equity and equity-related instruments of mid-cap companies |

| Benchmark | NIFTY Midcap 150 Total Return Index |

| Assets Under Management (AUM) | ₹8,072 crores (as of March 31, 2023) |

| Expense Ratio | 0.43% |

As of March 31, 2023, the top 10 holdings of the PGIM India Midcap Opportunities Fund are:

- Jubilant FoodWorks Ltd. (3.29%)

- Navin Fluorine International Ltd. (3.09%)

- The Phoenix Mills Ltd. (3.04%)

- Indraprastha Gas Ltd. (3.00%)

- TI Financial Holdings Ltd. (2.95%)

- Timken India Ltd. (2.94%)

- Persistent Systems Ltd. (2.92%)

- Abbott India Ltd. (2.77%)

- Cholamandalam Investment and Finance Company Ltd. (2.73%)

- Cummins India Ltd. (2.68%)

These stocks represent a diversified portfolio of mid-cap companies across sectors. The fund manager uses a top-down and bottom-up approach to select stocks and considers factors such as growth potential, valuation, and management quality.

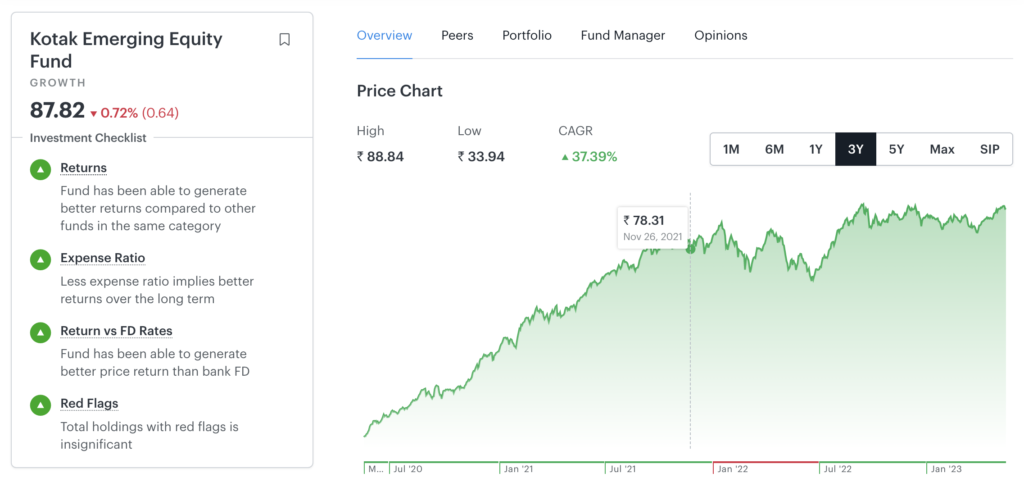

Fund 2: Kotak Emerging Equity Fund

Kotak Emerging Equity Fund is the second and new addition to my midcap portfolio.

Some more details about the fund:

| Name | Kotak Emerging Equity Fund (Direct Plan) |

| Investment objective | To generate long-term capital appreciation by investing predominantly in mid-cap companies. |

| Asset size | ₹25,972 crores |

| Expense ratio | 0.41% |

| Benchmark | Nifty Midcap 100 Index |

Here are the top 10 holdings of the Kotak Emerging Equity Fund (Direct Plan) as of March 31, 2023:

| Holding | Weight | Sector |

|---|---|---|

| Supreme Industries Ltd. | 4.30% | Capital Goods |

| Schaeffler India Ltd. | 3.71% | Auto Components |

| Cummins India Ltd. | 3.53% | Auto |

| Persistent Systems Ltd. | 3.47% | IT |

| Timken India Ltd. | 3.24% | Auto Components |

| L&T Technology Services Ltd. | 3.12% | IT |

| Shriram Transport Finance Co. Ltd. | 3.05% | NBFC |

| Adani Transmission Ltd. | 2.98% | Utilities |

| Lupin Ltd. | 2.96% | Pharma |

Fund Overlap

Now, while adding another mutual fund that invests in the same category, it’s important to consider the fund overlap.

Mutual fund overlap refers to the extent to which two or more mutual funds hold similar securities in their portfolios.

When investing in multiple funds within the same category, it is essential to calculate the overlap to understand the level of redundancy or concentration in your investment holdings.

You don’t want to be investing your money in 2 funds that eventually invest in the same stocks.

Now, the mutual fund overlap between PGIM India and Kotak Emerging Equity Fund is somewhere in the range of 20 to 25%.

This changes over time but usually stays in the same range.

And I’m completely fine with this much overlap.

So that’s my updated midcap mutual fund portfolio. I’ve also added a new fund (and replaced a previous one) in my small-cap portfolio. I’ll be writing a different post about it. Stay tuned!

Hi Rishab. Reached here from your YouTube channel. Thanks for sharing your valuable knowledge. I had a question. With so much of fraud and cheating in even some of the most renowned mutual funds, dont you feel scared of investing your money in them, especially when the kind of money you are putting in. It’s like handling your hard earned money to a stranger and then then trusting them with handling it carefully and with prudence. I was thinking of investing too in mutual funds but this thought stopped me from going forward with it. Any of your mutual fund houses can be closed down or get involved in cheating and fraud and then go down a spiralling journey taking you and your money along with them. I wanted to know your thoughts on this. Did you also think like this or are you not at all worried?

Honestly, I don’t really think about this.

There are some things we have to let go. We cannot control everything. We should play safe. But I know where the limit is to play safe. Eventually, no one can be trusted if you think of it this way – your country, your politicians, your banks – nothing is safe. But we give trust to these institutions in exchange we do get returns.