It is said that the right approach to investing and designing your equity portfolio begins by “knowing yourself”. And it’s not just about knowing your current financial status and your investing goals, but also about your ‘philosophy of investing’.

What approach to investing suits you the best comes down to the following factors.

Table of Contents

Decide Your Investing Approach

- Your age: Time is the most important factor in compounding and compounding is the most important factor in investing

- Your risk profile: Knowing how aggressive you are in talking about risks depends on your financial responsibilities and personal attitude. Do you panic easily when you see your portfolio in red? Do you like researching businesses? etc

- Your goals: These are the least important in my opinion as money should grow for its own sake rather than to just meet a goal like buying a house or educating children.

- Your philosophy: Do you believe in certain industries and companies and want to invest in them to watch those industries grow? Or do you just want to have your personal assets grow over time irrespective of the means?

My Investing Approach

I started investing only in 2016 (at the age of 25) and learnt a few things about the stock market before I started:

- The overall market will always fall

- The overall market will always come back up and make new highs

- Individual companies can behave more erratically and may or may not always come back

While these seem like 3 very simple statements, they helped me navigate the market cycles pretty well.

My approach boils down to the following:

- I believe India will grow as a country and hence the overall market in India will always make new highs in the long term

- Investing in an Index via SIP (for rupee cost averaging) is the best way to follow market returns

- There are certain industries and businesses that I personally believe in and want to invest in them directly

- These direct investments will always be large-cap companies in the NIFTY 100 universe (the top 100 companies in India by market cap)

- Since I make a decent income and I’m young, I’ll also have exposure to midcap and small-cap companies.

- However, since I want to focus on my core business and skillset instead of trading, I invest in midcap and small-cap companies only via mutual funds.

My Investing Portfolio

In this article, I will focus on the equity portfolio instead of my complete investing portfolio. In terms of the % of my portfolio in equity, It keeps changing from time to time.

Most people recommend the following:

% of total investment in equity = 100 – your age

So, as of writing this post, I’m 31 and my equity portfolio is around 70%. However, this is really by chance and not because I want to follow the formula exactly as it is.

Traditional investing theory suggests having the rest of the investment in risk-free debt.

However, the rest of my Investment Portfolio is split into real estate, gold, crypto, and some bonds too. And instead of holding cash, I feel to keep it in a liquid fund. I can withdraw it anytime I see an opportunity to invest more in a particular asset.

My Equity Portfolio

Now, let’s get down to the actual equity portfolio.

I use Zerodha Kite and Coin apps to manage my entire equity portfolio. You can sign up here.

Here’s how I have structured my portfolio and while it does change from time to time, eventually I rebalance it to the following split:

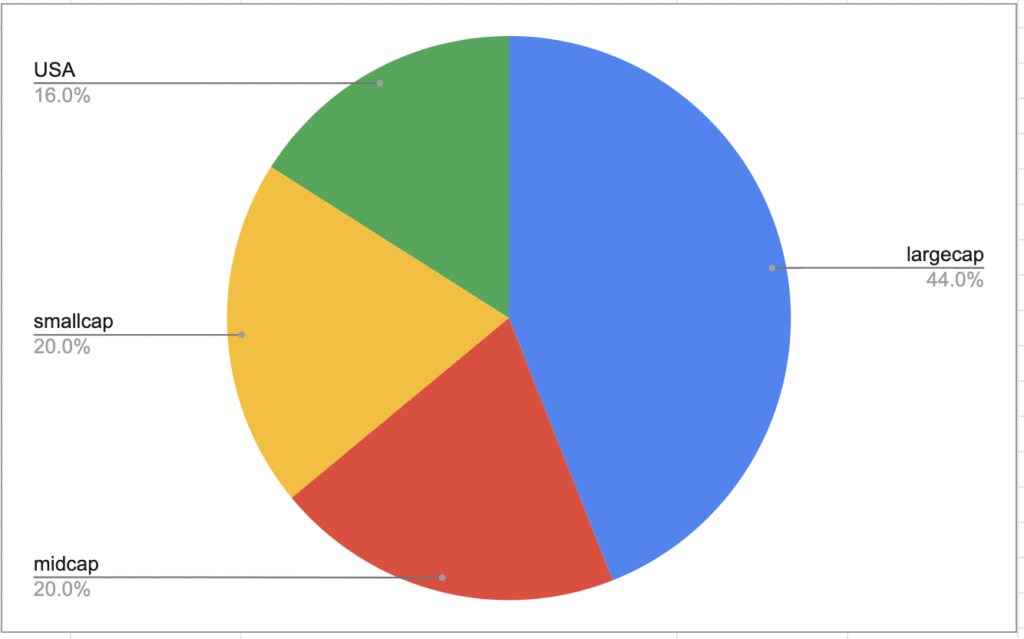

| NIFTY 50 ETF | 8% | largecap |

| NIFTY NEXT 50 (ETF) | 6% | largecap |

| MIDCAP 150 (ETF) | 10% | midcap |

| PGIM MIDCAP FUND | 10% | midcap |

| AXIS SMALLCAP FUND | 20% | smallcap |

| NASDAQ 100 (ETF) | 8% | USA |

| S&P500 INDEX FUND | 8% | USA |

| INDIVIDUAL STOCKS | 30% | largecap |

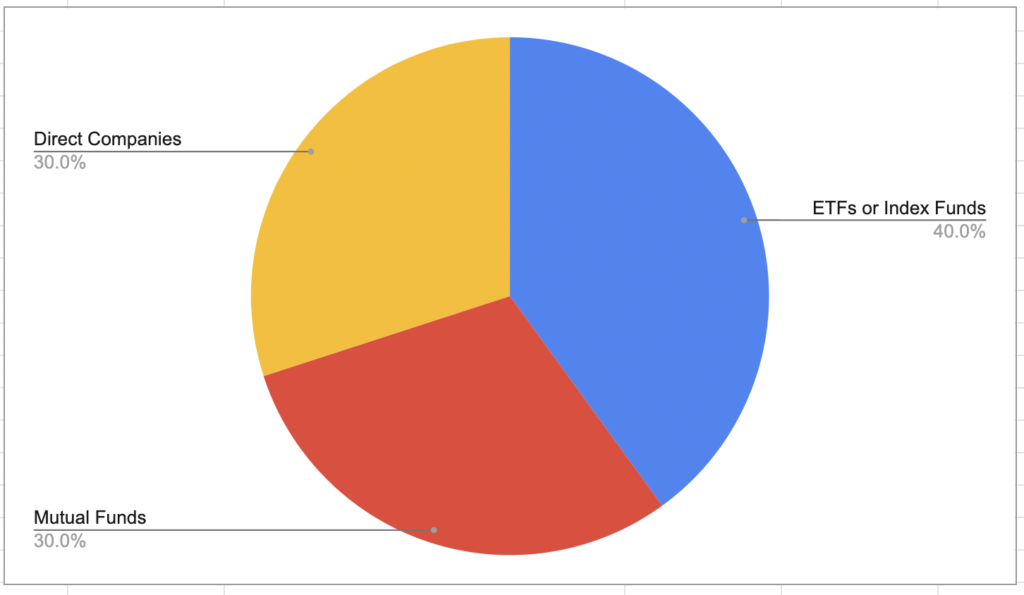

As you can see, 40% of my portfolio is in the market index (both India and USA), 30% in mutual funds, and 30% in to direct companies i.e. individual stocks.

I have come up with this split based on my investing profile. I want to get market returns over a long time on 40% of my money, give 30% of my money to fund houses to manage midcap and small-cap investments for me, and invest 30% of my money directly in companies I like.

In terms of the split between large-cap, midcap, and small-cap companies, 20% of my portfolio is in midcap, 20% in smallcap and the rest 60% in large-cap companies.

Midcap and Smallcap companies do offer exciting opportunities for long term growth as they can grow much more than large-cap companies.

However, I like to limit midcap and small-cap companies to 40% of my total equity portfolio.

So that’s my full equity portfolio! I’ haven’t mentioned the names of the individual stocks I’m currently holding as this is the 30% where I do swing trades from time and time.

However, some of the individual stocks I’ve been holding for a while are:

- TATA POWER

- TATA MOTORS

- L&T

- HCL TECH

- RELIANCE

There are others in the list but they’re all from the NIFTY 100 set of stocks so I’m still counting them in my large-cap allocation.

There are some midcap and small-cap stocks too that I swing trade at times but the allocation to those is too small to be counted into my long term portfolio strategy.

That’s all for this article. Hopefully, I’ve given a direction for portfolio design to those who are building their own portfolio in terms of ideas they can use. Do not treat this as investment advice and recommendations. I’m not a financial advisor and what works for me may not work for you.

All the best and I’ll surely post an update to the article in case my portfolio strategy changes in the future.