Over the past 10 years, I’ve run multiple experiments to grow my money with marketing. I’ve tried various models to manage experiments, processes, and mindsets. This year, I’ve created my own model to simplify everything I do.

I call this the CRI model and it stands for Channels-Revenue-Investments.

The CRI model covers:

- Channels – where I get people’s attention through content or outreach or marketing hacks)

- Revenue – these are the revenue streams, products, and services people actually pay me for or exchange money for some value being created for them

- Investments – these are the investment classes where the money goes rather than sitting in an account

I review these 3 every month and make sure they are optimized. This keeps me on top of my game in terms of both money and marketing.

Who can use this model:

- Businesses

- Independent Consultants

- Freelancers

- Digital Nomads

- Entrepreneurs

Let’s cover the fundamental concepts of the model in detail:

Table of Contents

CHANNELS

People are money. When people know you can create value for them, they will exchange the value for money at some point.

Remember:

All money is other people’s money.

To get people’s money, you first need to get their attention. To get attention, you need to use the channels where people hang out. These could be online or offline channels. For example, you are reading this blog now and I have your attention.

Once you know the channels for your audience, you start getting attention either by creating content, or advertising, or outreach or running marketing hacks on the channel.

This is the first stage of the CRI model.

REVENUE

People will exchange money for the value you can create for them. This could be through a product or service. At this stage, you want to make sure you create more value for them than the money they pay you. This makes sure they keep coming back for more.

Remember:

Money is valuable only for what it’s exchanged.

This is the stage where you define your revenue streams. Once you know what people need, you can pitch them different revenue streams naturally. A regular office-going employee might have just one revenue stream which is why this model is not for the average Joe.

Revenue is the second stage of the CRI model.

INVESTMENTS

Once you’ve got the money, you don’t want it to stay (and reduce value) in a bank account. You want to put it to use and make it work for you.

Remember:

Make your money work for you more than how much you worked for your money.

This is the stage where you define all the investment classes you will put your money in so it can grow. The better returns you get on your investments, the more you can make with your existing money.

Investments are the third stage of the CRI model.

How to Document Your CRI

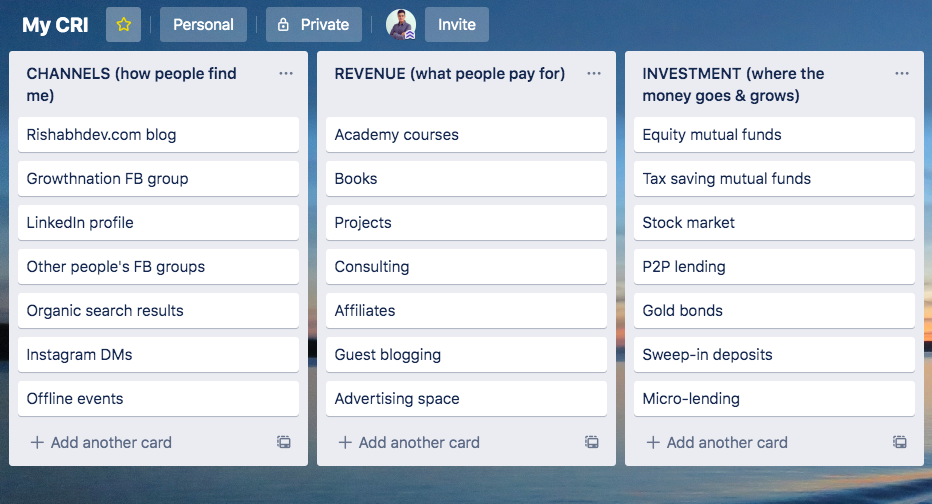

I like to use a Trello board only to document my CRI.

Just write each channel, revenue stream and investment class in cards and describe the card in the description field on Trello if you wish.

Here’s a screenshot of a sample CRI model overview:

This year, write down your CRI and document the CRI model. This will help you get clarity, find potential optimisations, and grow.

Feel free to share your thoughts and suggestions in the comments below.

All the best!

Related resources:

- Side project list (these are all potential revenue streams)

- Personal finance journey (how I make my money)

- 101 Ways to Grow your Startup (hacks to leverage channels and attention)

1 thought on “The CRI Model of Money & Marketing”